The best time to start a tech startup was when the dot com era was becoming mainstream. The second best time is now. But the best time to go public is evergreen. In this article, we are going to look into the IPO process – one that is designed to effectively give a chance to businesses and individuals to invest in startups that you created. When it comes to raising funds for startups, the one preferred direction that the tech companies are moving towards is Global Initial Public Offering. With venture capitalists and crypto enthusiasts fanning the flames, a new form of raising funds for startups has now gotten mainstream for tech companies across the globe.

In fact so much so that it is soon becoming the ultimate objective of brands, especially since Uber, Pinterest, Slack, and other innovative tech companies acting as the torchbearer.

Let us get down to the basics and some present time statistics first before getting down to the process of raising an IPO.

Table of Content

- What is an IPO – the preferred way to raise funds for a startup?

- What are the benefits of an IPO

- The Ongoing Trend of Tech Companies Going Public

- Signs That You Are Prepared to Go Public Through IPO

- How to get IPO ready – The roadmap to navigating the process

What is an IPO – the preferred way to raise funds for a startup?

An Initial Public Offering or IPO as it is generally called is a process of offering the shares of a private corporation to the public through the issuance of new stock. Ever since Apple and Google went on to become public with their stocks being traded as a ticker symbol in the market, raising an IPO has become something of an endgame for emerging tech companies.

The median deal size of IPOs continue to raise year on year is only a plus side of why companies are sold on the idea of going public now more than ever.

It has become more than a process of raising capital for startups – it is now a way to prove the worthiness of a company.

What are the benefits of an IPO

Tech startups generally tend to look up to IPOs as the long term way of raising money for startup that they have created seeking one or all of the following benefits:

- Increase in the long-term capital

- A greater cash access and bettered liquidity

- An opportunity for the initial founders or the investor groups to take the cash out

- Monetization and rewards to the employees through shares

- Augment the company’s visibility and stature in the industry

The ongoing trend of tech companies going public

Fundraising for business startups in the technology sector is not unheard of. While generally limited to Series A to E funding and taking unconventional routes to raise money for business startup and even being a torchbearer of making ICOs a better proposition than VCs, they too have started sharing the great american dream to go public.

Initiated by Apple and Google and strengthened by Lyft, Pinterest, Fiverr, Slack, Zoom and the likes a number of tech companies are already or are getting prepared for startup fund raising through Initial Public Offering.

Here’s a visual representation of them –

But just because these tech companies felt they were ready to go public, does it mean the startup funding process is the ideal next step for your tech company as well? After all, with the world unable to give an exact answer on when is the right time to choose IPO as a startup fund raise method, how do you decide when to have an IPO?

Signs that you are prepared to go public through IPO

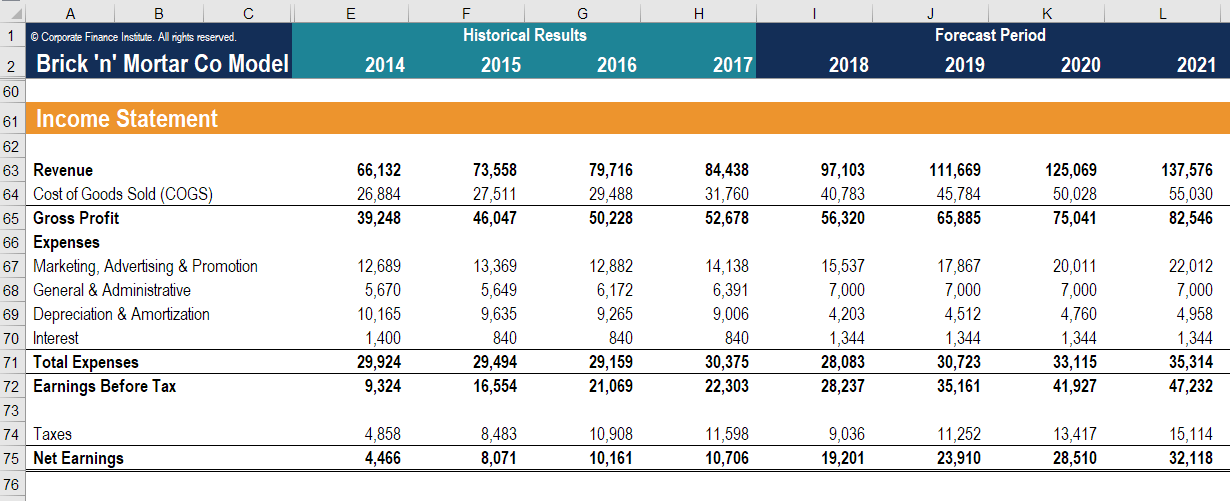

1. You can forecast financial growth

Accurate financial projections is key to efficient business strategy playing a massive role in a company’s growth, especially as a public company. Creating an accurate estimate of budget and forecast as your company operates privately is a key step in establishing the consistency and accuracy of financial reporting for gaining credibility with the investors.

2. You have the best executive team

You have a team that has experience of being a part of a public company, who understand the nitty-gritty of running a private turned public company. In addition to a strong current team, you have also estimated the need of expanding your finance, accounting staff in addition to people handling external communications – to aid the process of going public.

In addition to your best-in-class executive team, you also have partnered with the most skilled software developers for startups that know how to digitalize and prepare a private tech company for going public.

3. Your company is always audit-ready

Before going public, you would want to get in a position where you constantly close quarterly financial statements in time. Even the companies that are backed by venture capital and private equity find it challenging to offer regular reports to their sponsors and board. By going through the exercise months in advance, businesses are able to get ready for the public reporting, stress-free.

4. You have a strategic roadmap

A strategic roadmap is a blueprint of a company’s investment growth chart. It provides an operating strategy for growing business for providing investment returns which the prospective shareholders want from a public company.

5. You have a strong business case for raising an IPO

One of the most obvious reasons for getting an IPO is to gain access to the capital market and raise additional capital – the end goal of a startup investment process. An IPO is a major company evolution milestone and a symbol of your company being able to satisfy the necessary government standards and compliances.

6. You have developed a network with investors

Something that makes the process of raising IPO easier and actually enjoyable, is knowing some of the key people in the investment firms. Although you must have already done your homework, let us expedite the networking process by giving you insights into which investors have been backing the tech IPO journey of companies –

How to get IPO ready – The roadmap to navigating the process

1. Hire the best team

Selecting the best team of professionals to handle your IPO process is important for the success of your business. Here are some of the entities that should be a part of your team, in addition to the obvious inclusion of lawyers –

- Tech Service Providers – The success of an IPO depends entirely on the software you are selling which are a result of the well-strategized software development services for startups. After all, all the tech giants who have taken the route of IPO ensured that their digital offerings were useful and best in class. Ensuring this is the work of a startup software development company. So, we would recommend choosing the best software development agency for your digital transformation needs.

- Investment Banks – The banks act as a mediator between the companies looking to issue an IPO and the investors – while acting as an underwriter. The banks are involved in a number of processes like document preparation, issuance, marketing, filing, documentation, etc.

2. Perform due diligence

The underwriters, lawyers, and banks work together to conduct an in-depth audit of the company. Their review includes legal, tax, financial, customer verification, and market research. The intent is to create complete transparency in the company’s operations and presume risks.

3. Build IPO prospectus

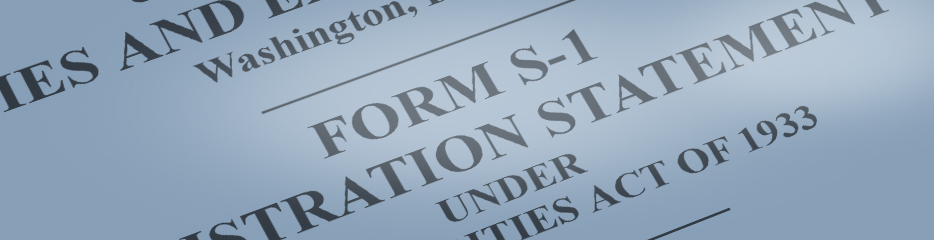

The IPO lawyers and company use the due diligence information for drafting the principal offering files which include IPO prospectus that should be filed as a part of IPO registration.

The IPO prospectus highlights the company’s strategy, strengths, market share, financials, investments, and products. It should also mention the risks that are involved for the investors.

IPO prospectus is subjected to expansive disclosure needs meaning it is important that the parties collaborate for ensuring the prospectus is accurate.

4. File IPO registration statement

The IPO lawyers file IPO prospectus and the complete registration statement with SEC. This 30 days review process is subjected to reviewing and commenting by SEC. After this process, companies then complete the initial listing application round with exchange. The underwriters then file compensation information for IPO with FINRA.

5. Pre-IPO

Although it may not be difficult for funded tech companies as they have already gone through the stage of marketing when they were raising money for their startup. They only have to do it at a much wider scale now with investment banks’ help. What you did Before IPO, investment banks popularize it to the private investors for maximizing company’s position in the market. The investors are usually hedge funds or private equity firms willing to buy shares in the company.

6. IPO “Roadshow”

Before several weeks of the IPO, bankers and management team hold a “roadshow” – a series of presentations in which they market the IPO to prospective investors. It is usually when they first announce the offered price range and size of the shares. The intent is to gather interest from the investors for driving up the initial sales price.

7. Initiate Trading

After the roadshow, bankers set up a price determining the initial share value. A few days after that, the IPO closes and stakeholders have to release their shares. After the shares have been released, investors who purchased the shares get allocation and the public trading officially begins.