Companies in every industry are facing the challenge of evolving digital capabilities given their current operating models, resources, talent and culture. These elements are so intrinsic that any digital transformation not addressing them will ultimately fail because the legacy organization will inevitably exert a gravitational pull back to established practices, while agile competitors forge ahead. Some enterprises may be further along than others, but in most industries there are only a few companies that have made significant progress.

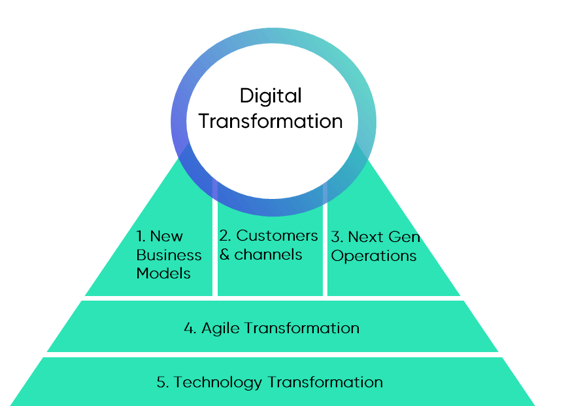

Becoming a digital enterprise is a complex and lengthy journey. It is much more than implementing predictive analytics or intuitive eCommerce experiences. Beyond product/service innovation, the journey demands attitude change in agility, experimentation, openness and transparency. However, for now let us focus on the digital core levers that CIOs and their teams can use to accelerate transformation –and how industries’ different use of digital enablers leads to different routes to digitilization.

Digital core enablers – technologies that realize digital transformation

As I explained in the first blog of this series, a digital core represents a set of loosely coupled cloud-enabled and SaaS business applications integrated with analytics and big data, on top of an elastic, yet resilient, data platform. A digitalized enterprise core enables a scalable, enterprise-wide digital strategy with the intent to accelerate business innovation through insight-based customer, partner and employee engagement. This transparency and automation drives optimization of business process and asset utilization, as well as employee productivity, and allows forays into new business models beyond the industry.

The digital core components accelerate the benefits of digital transformation by:

- Enabling creation of engaging and effective customer, employee and partner “experiences,” leading to adaptable, collaborative transactions

- Optimizing end-to-end business processes, even extending them beyond the enterprise to improve business efficiency and effectiveness

- Innovating current business models that open potential for net-new revenue from products and/or services in unexplored market segments or via cross-industry collaboration and/or digital business platforms.

Digital core demands a hybrid transactional and analytics data platform

So, where should most enterprises start? While the hype about cloud-native, loosely coupled microservice applications is raging, there is a quiet revolution taking place enabling the sensible modernization of a business operational core. SAP, Oracle, Microsoft Dynamics, IBM, Workday, Salesforce and other vendors are increasingly offering “in-process,” hybrid transactional and analytical business applications based on optimized, ACID-compliant, columnar databases sharing one data platform. These merged platforms support data harmonization and application consolidation from a value stream perspective into one data store — with significant impact on TCO. In-process applications leveraging translytical data platforms or hybrid transaction/analytical processing (HTAP) accelerated by in-memory computing are disruptive. Companies can optimize business process execution by meshing many of the digital core enablers like real-time analytics (for example, planning, forecasting, outcome simulations and what-if analysis) in transactional execution, rather than performing them as separate activities after the fact.

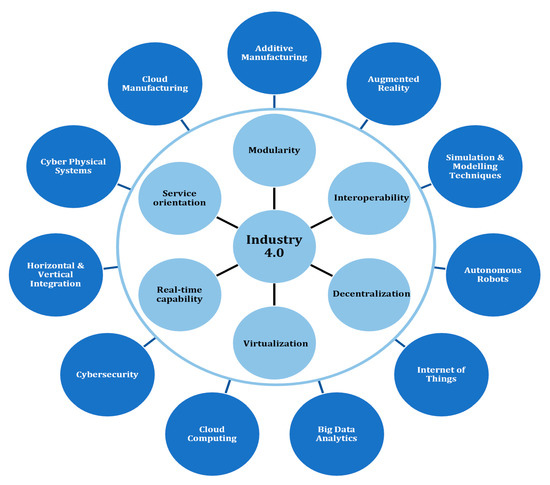

Beyond this potential transition route to a digital core by consolidating applications into transanalytical data platforms, big data (Apache Hadoop) repositories can complement the reach of core applications by infusing additional external or sensor-based data to transition from manual to sense-and-respond, event-driven processes. As shown in the graphic below, these digital enablers may even “blur” the boundaries between industries, therefore enabling cross-sector collaboration.

Digital enablers disrupt industries and break down boundaries

Recent disruptive competitive moves by Amazon into transportation and financial services reinforced the importance of establishing a hybrid data platform that drives internal optimization and allows competitive moves into new services and products.

While different industrial sectors have a natural proximity to some of the digital enablers shown below, there is a rising consensus that the transparency and insight provided by richer data in analytical and big data repositories are the “fuel” of automation. Most of the technologies highlighted as disruptive in the graph below revolve around the utilities of artificial intelligence and machine learning.

Becoming digital – a maturity and context-based approach per industry

Recently, researchers from the McKinsey Global Institute (MGI) looked at the state of digitization in sectors across the United States and Europe and found significant gaps between many of them. Most digital companies see outsized growth in productivity and profit margins. But what are the key attributes of these digital leaders, and how can companies benchmark themselves against competitors? MGI’s digitization index encompasses (a) digitization of assets, including infrastructure, connected machines, data, and data platforms, (b) digitization of business operations, including processes, payment and business models, customer and supply chain interactions and (c) digitization of the workforce, including worker use of digital tools, digitally skilled workers and new digital jobs and roles.

The industry digitization dashboard below shows the digitization maturity scores. The IT technology sector comes out on top. Media, finance and professional services are right behind. Not surprisingly, these are some of the industries that currently invest in cognitive AI for operations and services, which in many ways demand a rapid modernization of their business operational cores.

No doubt the extent to which companies are digitizing their physical assets and supply chains and enabling their knowledge workers — that is, if they have smart buildings, connected vehicle fleets, big data or IoT systems and information at their employees’ fingertips – determines the performance they get out of equipment, systems, and business networks. However, different states of maturity with such enablers demand a varied approach by industry. For example:

- A consumer-products company will benefit from focusing its data and automation efforts on establishing a synchronized supply network able to respond to events from their customers. The fourth recommendation above shows that digitization of the B2B channel through “intelligent shelves” will improve forecast accuracy and trade promotion efficiency and evolve from a make-to-stock model into a make-to-order product flow. That in return will demand a transition from forecasting to response planning and big data repositories that sense, categorize and act upon on-shelf shortages. Product and packaging fragmentation will further demand digitization of the heart of manufacturing.

- Asset-intensive industries like utilities can leverage AI to drive improved matching of supply and demand, which needs to be done, literally, in real time. With the addition of smart metering sensors, utilities have been able to progress from forecasted to actual consumption billing, but more importantly, to increase accuracy of their short-term load forecasts in order to adjust supply to meet anticipated demand. This delivers substantial savings, reduces waste and emissions and adds further system resilience via predictive and preventive maintenance.

- Service- and labor-intensive industries like retail need to improve their interactions with consumers by improving the omni-channel experience and empowering their employees towards higher productivity via mobile-enabled tools, while collecting and bargaining using the wealth of information on behavior and assortment. Efficient logistics, goods tagging and placement can be automated.

In summary, by understanding their digital maturity vis-à-vis their peers and even related industries, companies can streamline the deployment of a digital core, focusing on business model optimization or innovation while enhancing their business network experience. Easier deployment of digital enablers is one of the benefits of a modernized digital core. Advanced analytics, IoT, AI/ML, robotics, algorithmic operations and blockchain can transform how companies create and manage digital assets, accelerate supply-to-demand, facilitate digital experiences and empower digital workers towards higher productivity.

In my next blog post, I’ll write about how a digital business platform extends an enterprise’s digital core into the broader business network and allows for end-to-end value stream optimization of current operations.