The Finance world, while having established itself as a secure industry is also the one that frequently becomes the victim of a number of glaring issues like lack of transparency, a still less real-time ecosystem, and a case of slow digitized adoption.

All the prevalent bickering, questioning voices when meet with issues like the 2017’s attack of a Trojan horse virus Ramnit which affected the financial sector widely, accounting for around 53% of attacks, becomes a voice seeking complete transformation.

A transformation that 2019-2020 is expected to bring with it.

Attacks like this and several others, along with the need to bridge the gap between the general population and the real-time access of their money, has brought up a dire need of adding technological innovations into the traditional financial processes to improve its status quo and deliver better services to the end users.

A technological innovation known as Fintech.

Fintech or Financial technology is revamping the Financial as well as other business verticals by significant numbers. The pace at which FinTech is moving has ensured that the popularized segment will contribute to 25% of the revenues that the Financial sector would draw.

This has increased the necessity to develop a Fintech app and embrace the Fintech solutions into our business, about which we will discuss in this blog – starting with the importance of considering Fintech app development.

Why Invest in Fintech App Development in 2019-2020?

From Coinbase to Avant, Credit Karma, Mint, and Stripe, several fintech solutions have changed the way companies have been doing business so far. They have transformed the traditional business models and made it necessary for businesses to invest in Fintech mobile app development in 2020 and beyond, if they wish to avail benefits such as:-

1.Easier Payment Process

The foremost reason to develop a Fintech app in 2019-2020 for businesses is easier payment process. The Fintech solutions prevent the consumers and business owners from going through the cumbersome, time-consuming process of cash and credit/debit card based payment. The transactions can be easily made online using banking apps, digital wallets and even Cryptocurrencies (which are gradually resulting in the rise of Blockchain wallets in the market).

*Side Note* Fintech, by embracing Blockchain technology, is not just set to revamp the future of transaction, but has eliminated the intermediaries, added transparency and security to the process, and accelerated the whole mechanism, which has brought a sense of satisfaction among both the customers and business owners.

2.Evaluating Risks Effectively

Fintech solutions have taken the market by storm by making it easier to predict and overcome risks. It scans a vast amount of information from different sources and uses a wiser approach while lending loan or making any transaction, which is cutting down the risk of errors and frauds.

3.Faster Investment

Fintech has eliminated the need of hiring a human financial advisor by providing 24×7 consultation and advice through mobile apps. This has accelerated the process as well as provided us escape from biased suggestions. Besides, Fintech solutions have brought the banking and non-banking organizations on the same platform which has opened new doors for Entrepreneurs in terms of gaining loans and investments.

4.Lower Cost

As per the market insights, the primary challenge to entry into the financial business has been cost. By making the financial services available on devices that millions of people have, i.e. smartphones, Fintech has improved the PoS (Point of Sales) system and cut down the expenses of the businesses, along with gaining sophisticated analytics data to better engage their audience.

While these are some of the prime reasons making investment in Fintech a profitable deal, there are various factors that have placed Fintech at a prominent place in not just the present but also the future of a number of business segments.

Something that we are cover now.

What makes Fintech the Driving Force of Future Businesses?

Fintech is proving to be a disruptive force for the financial and other business verticals. It is helping them improve their business models and lessen the associated risks – be it payment, lending process, wealth management, or any other such finance-related activity.

The technology is adding higher value to the consumer experience and market strategies by incorporating cutting-edge techniques and tactics into the process, which is eventually drawing the time of disruption of the future of business world.

A few factors that are ensuring the prominent presence of FinTech in the world around us are:

1.Rise of Millenials

The foremost factor that made Fintech a disruptive force in the business world is the millennial generation. The millennials highly depend on social media platforms for gaining information or financial advice, which has been a challenge for the conventional financial institutions. They are more demanding and less loyal – asking for personalized services at the speed of light.

As per a report, 1 out of 3 millennials changes their bank in every three months in hope of getting desired experience, which is increasing the need for technological advancement in the Financial industry, i.e, the rise of Fintech solutions.

Fintech startups and established companies, as compared to the conventional financial institutions, are offering better services at data utilization and customizing the options as per the users’ needs and preferences using technologies like artificial intelligence for finance, which is making millennials far more satisfied and helping businesses gain higher revenue.

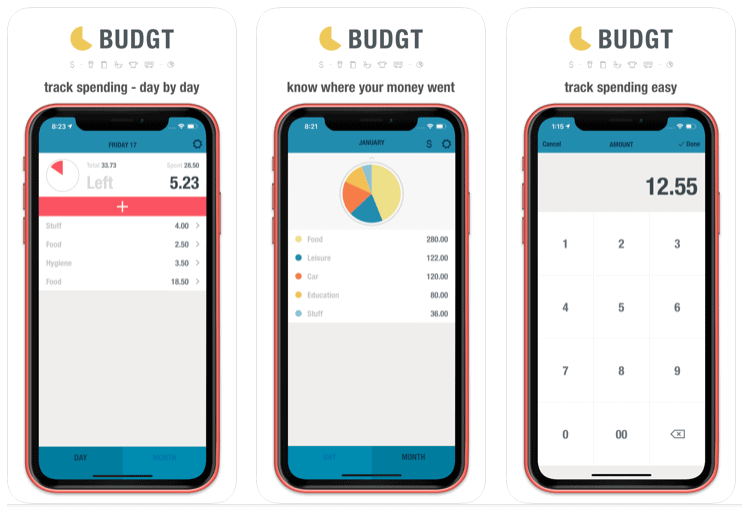

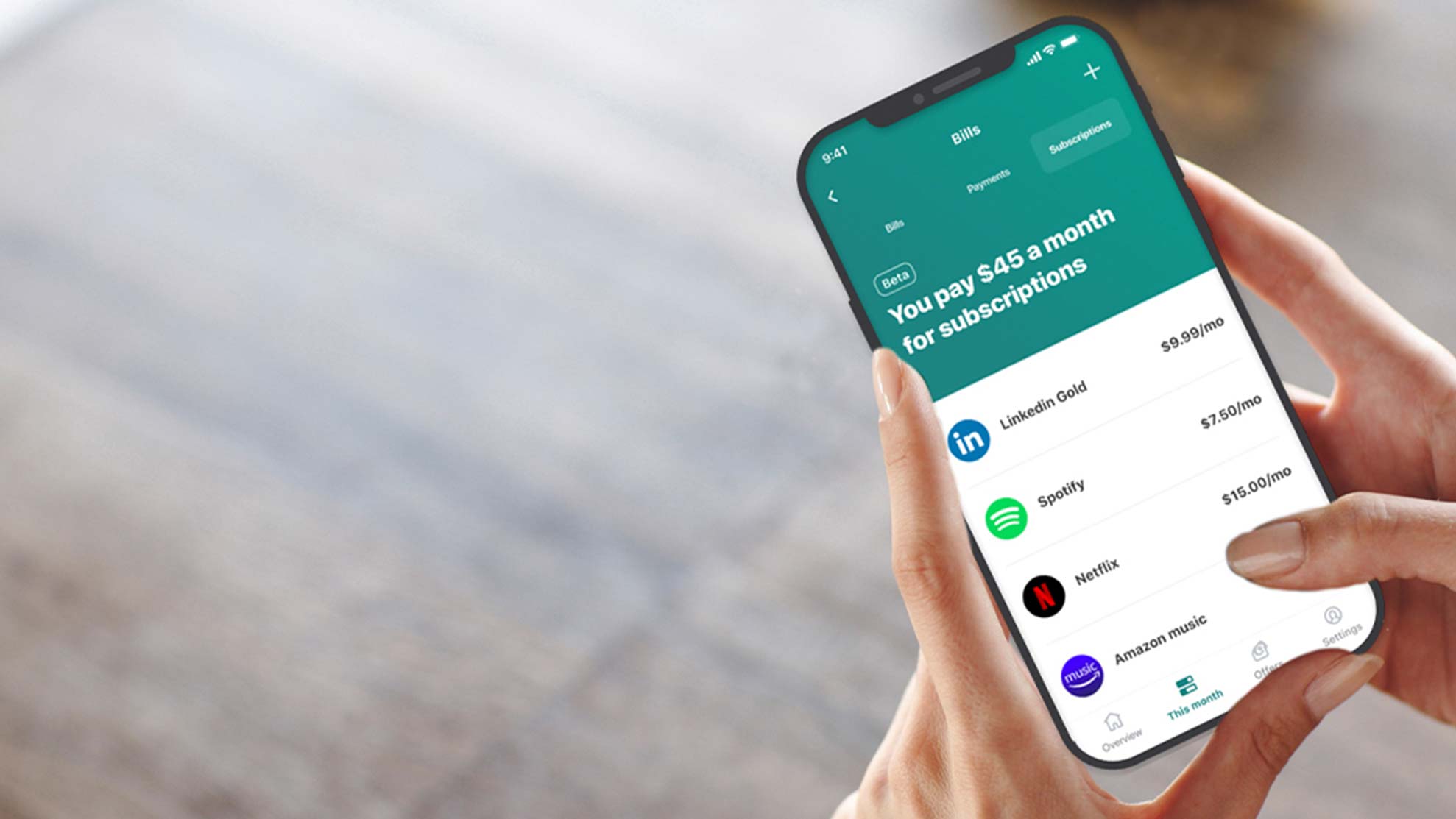

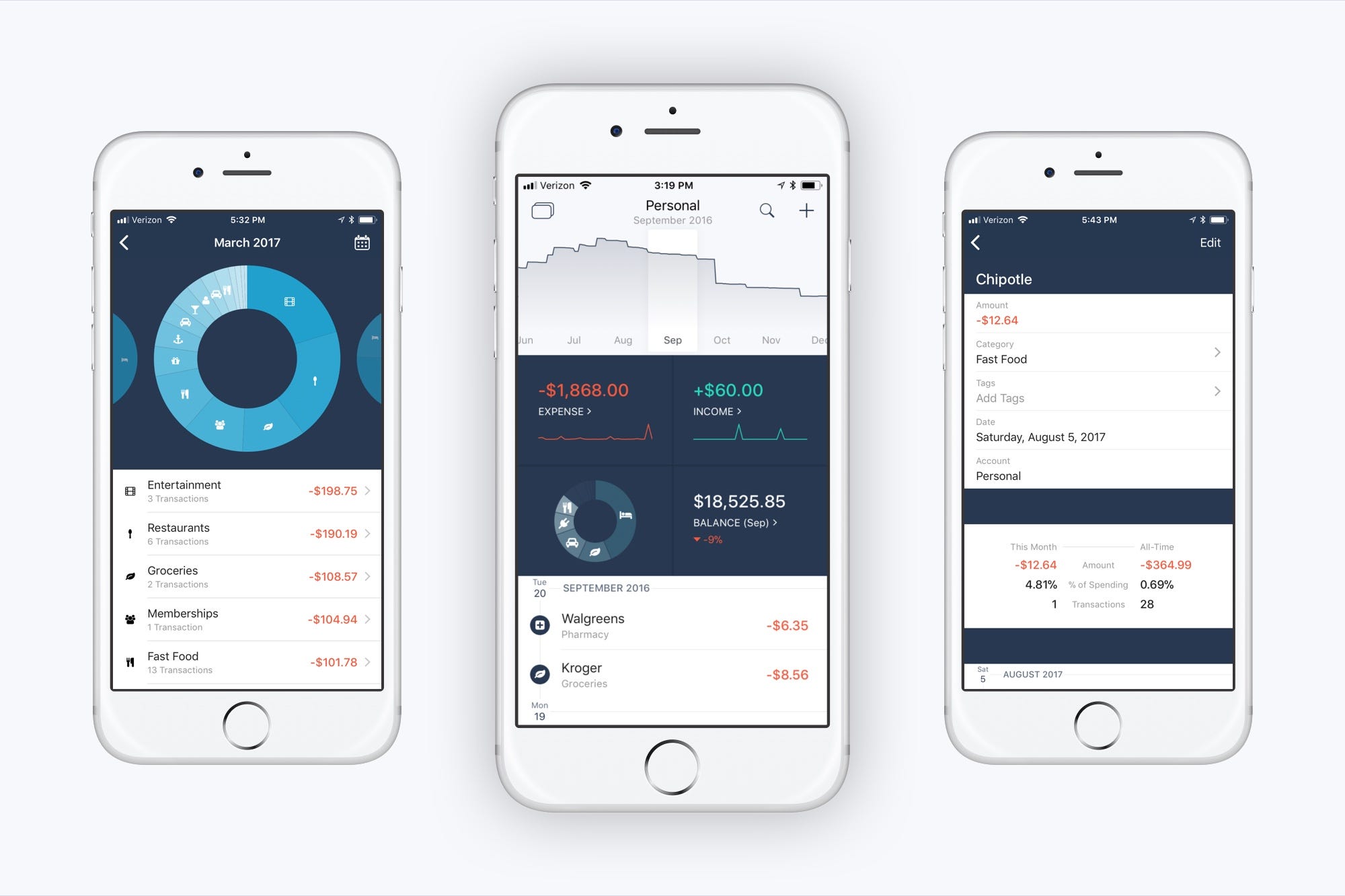

2.Payment Apps and Digital Wallets

The surplus use of P2P payment apps and digital wallets, has not just bought a rise in the query on how to develop a P2P app, but is also proving Fintech to be a disruptive force in the market. These payment apps and digital wallets are providing users with quick and secure access to their money and send/receive any amount at any time and pay their utility bills without running for their pocket or purse.

This convenience is gaining higher momentum in the market and encouraging the business to invest in Fintech app development, in an ode to join the list of most frequently used payment apps.

Now as you know what factors make Fintech a catalyst in the business world, let’s look into the impact of Fintech on different sector:-

Different Sectors Where Fintech is Bringing Considerable Changes:-

After revolutionizing the different process of banking sector, the Fintech technology has moved on to creating a considerable impact on other prominent businesses. But before we explore each business vertical individually, let’s look into what percentage of respondents in different industries think that Fintech will disrupt their domain, as shared in the image below:-

1.On-demand Economy

Fintech is transforming the On-demand economy in a multitude of ways – both for customers and drivers.

It is making the ride payment process one that is not suffering from any time lags by allowing users to connect their bank account with the ride-sharing apps, thus preventing any daly and time gap.

It is providing drivers with small business banking tools like expense management and automatic invoices which will ease the financial processes and upgrade their productivity.

The impact of FinTech in Ride-Sharing economy is so much so that in 2019, various insurance companies and Fintech startups will also invest heavily in the taxi-hailing industry, offering all the services to the users on the same platform. In addition to this, the top Blockchain-based Fintech apps like Coinbase will increase their interest in promoting making transactions and sharing e-gift cards in the On-demand mobile apps.

2.Healthcare

Fintech is spawning new opportunities in the healthcare industry, helping with mitigation of the current challenges and providing exemplary experience to both the patients and healthcare service providers.

On one side, the Financial technology is serving the industry with seamless payment solutions, while, on the other side, it is, in 2019-2020, poised to pave new ways for several lending and insurance purpose. Various medtech startups have added Fintech to their services in an ode to provide all the medical-related services under one roof, an example of which is Practo.

Also, a significant rise will be observed in the adoption of Blockchain technology in Healthcare industry, implying payment will be possible through virtual currencies (Cryptocurrencies) in addition to a higher level of data security through Smart Contracts.

3.Retail

The retail industry is enjoying a wave of revolution with Fintech app development, especially in the payment and customer experience facet. It is providing users with an omnichannel experience, making it possible for the customers to interact with the Retail stores via different platforms. It is also simplifying the payment and checkout process, helping the retailers to cater to a wider audience. Two relevant examples of the impact of Fintech app solutions on Retail business are Fingopay and Perpule.

It is not over yet. In 2019-2020, it is estimated that the technology will boost the marketing strategy by empowering retailers to know what order have the customers ordered, paid for and returned and thus, plan a loyalty program accordingly.

Besides this, digital payment apps and social messaging apps will coincide, implying 2020 and beyond will make it possible to perform retail centered payment from all the social media apps and message via payment apps. The retail platform, through the payment gateway integration process will aim at creating an omni-channel presence by making it possible for the users to checkout from everywhere – the app, website and social media.

4.Government Ruled Banks

Fintech is also reinforcing the government banks by offering them multiple digital services and platforms to connect with users and deliver transparent and impactful solutions. One way through which they would be achieving this, is through the introduction of Open banking.

Open banking- a collaborative model where banking data can be shared among two or more independent parties via APIs – enables the government organizations to enhance customer experience, generate better revenue, and build a sustainable service model for conventionally underserved markets via a decentralized approach which is far beyond lending and data sharing. This is empowering multiple fintech innovators as well as various one-off bank agreements, which was not possible with the traditional financial industry model.

5.Crowdfunding

Earlier, it was tough to gain visibility in the market and raise fund effectively due to lack of platforms, resources and historical data preventing startups and established brands from getting into the claws of the frauds. But, with the introduction of Fintech apps, the Crowdfunding process is becoming a lot more streamlined. The technology is bringing more effective and profitable approaches by fostering P2P payment, easing the process of follow up with the investors and assisting the fundraising process.

It is also encouraging established financial services institutions like banks and NBFC to turn towards online fundraising platforms to extend their reach and offer better services in the market as “alternative investment”. In this way, fintech technology is contributing to bridge the gap between public and private investment, which will open up new avenues to get funds from.

Though we have covered why and how Fintech application development is bringing a major impact on the business world, having a look at the future fintech trends can help you plan a better strategy. So taking the same thought forward, here are some of the Fintech app development trends to expect in the year 2020 and beyond:-

FinTech App Development Trends for 2020 & Beyond

There are a number of technologies and trends that will become more apparent in Fintech realm in 2019-2020 and foster innovation in different business verticals. Such as –

1.Blockchain will Become a Prominent Part of Fintech Strategy

Blockchain, the technology behind Bitcoin and Cryptocurrencies, have already been considered to improve the Financial services across different sectors.

While the impact of Blockchain on Fintech has mainly been restricted to banking and other sectors for trading and supply chain management, by 2020, the technology will create more opportunities in the field of Payments Infrastructure, Digital Identity Management and Funds Transfer Infrastructure. It will be considered by 70% of financial companies for creating immutable record of their sensitive financial information and use them safely and securely.

In addition to this, the blockchain and fintech convergence will reduce the number of unbanked from 1.7 billion to less than 1 billion by the end of 2020.

2.AI will Enhance Financial Consumer Strategy

The fact that Artificial Intelligence is one of the biggest disruptions in the business economy with almost every business vertical either embracing the technology or planning to add it into their process by the next 5 years (as shown in the image below), Fintech mobile app developers will show a profound interest in this technology.

Fintech organizations and development companies will add AI, Machine Learning and Predictive analytics to their tech stack to understand the customer behavior, choices and preferences, and deliver better customer experience along with automating a significant amount of work at their end.

3.New Payment Solutions will be Introduced

With the advent of mobile payment solutions, visitations to banks have reduced by significant value and it is further expected to drop by 36% by the year 2022. In the same time period, mobile payments will grow by 121% with over 90% of users expected to be turning towards digital wallets and contactless payment solutions.

Besides, a major disruption will be noticed in this context with the adoption of Bitcoin and other cryptocurrencies because of their characteristics like faster transactions, ease of cross-border payment and enhancement in infrastructure. It will all ultimately result in an heightened investment in Blockchain Wallets – a decentralized concept that we have talked about in great lengths in our Blockchain Wallet guide.

4.CyberSecurity will Get More Attention

According to a PWC survey, 69% of financial services’ CEOs admitted to be more concerned about cyber-threats, when compared to those belonging to other sectors. They further shared that though they are employing various cutting-edge technologies, the security threats are continuing to exist due to involvement of third-party traders, complex technologies concepts, cross-border information exchange, etc. As a result, the cyber intruders are able to steal sensitive information and make millions of dollars, as we have seen in the case of Bangladesh’s central bank.

To combat such situations, the organizations will embrace different Fintech technologies – majorly Big Data and Biometric authentication. They will employ Big Data to analyze and predict the upcoming internal and external security issues and respond at the earliest. Besides, they will add biometric authentication to their processes to ensure that no unauthorized person could get access to their data, which will increase security, build trust and reduce the efforts and cost of securing their data via traditional means.

5.Digital-Only Banks will Gain Momentum

With the increasing mobile based banking and other financial solutions, there will be lower-to-no need of a traditional bank in the future. This will boost the concept of Digital-only banks, i.e, banks that have no brick-and-mortar outlets but provide the users with an access to all the banking resources and services virtually and swiftly.

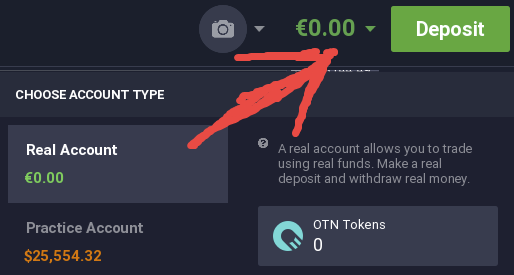

6.Higher Investment Will be Made in Fintech

As shown in the graph below, the Fintech investments have risen from less than $1M in 2014 to more than $20M by the end of the year 2018, and these numbers are expected to increase in the coming years – making Fintech one of the revolutionary sectors in the coming 4-5 years.

Besides, there are more than 20 fintech unicorns right now, with 50% of them raised their growth exponentially in 2018 and five of them made debut in the list. Many more newcomers are expected to follow the same roadmap and deliver innovative financial products to consumers and enjoy better ROI, as shown in the image below.

Fintech, as we have covered in this article, has opened up a new world of opportunities for the business world – helping them deliver more innovative services, make better profits and that too on a fraction of money they have been investing earlier.

The segment has been bringing a major impact on the present and future of the business world, implying every business owner need to look forward to investing in Fintech app development to provide the users with higher value and generate higher revenue.

So, contact our team today to add the optimal fintech solutions to your business model.

)